The bureau of labor statistics (BLS) just released the inflation number for January 2023 for the United States.

There is a 0.5% increase from the December number, and inflation sits at still a whooping high of 6.4% over the last 12 months from January 2022.

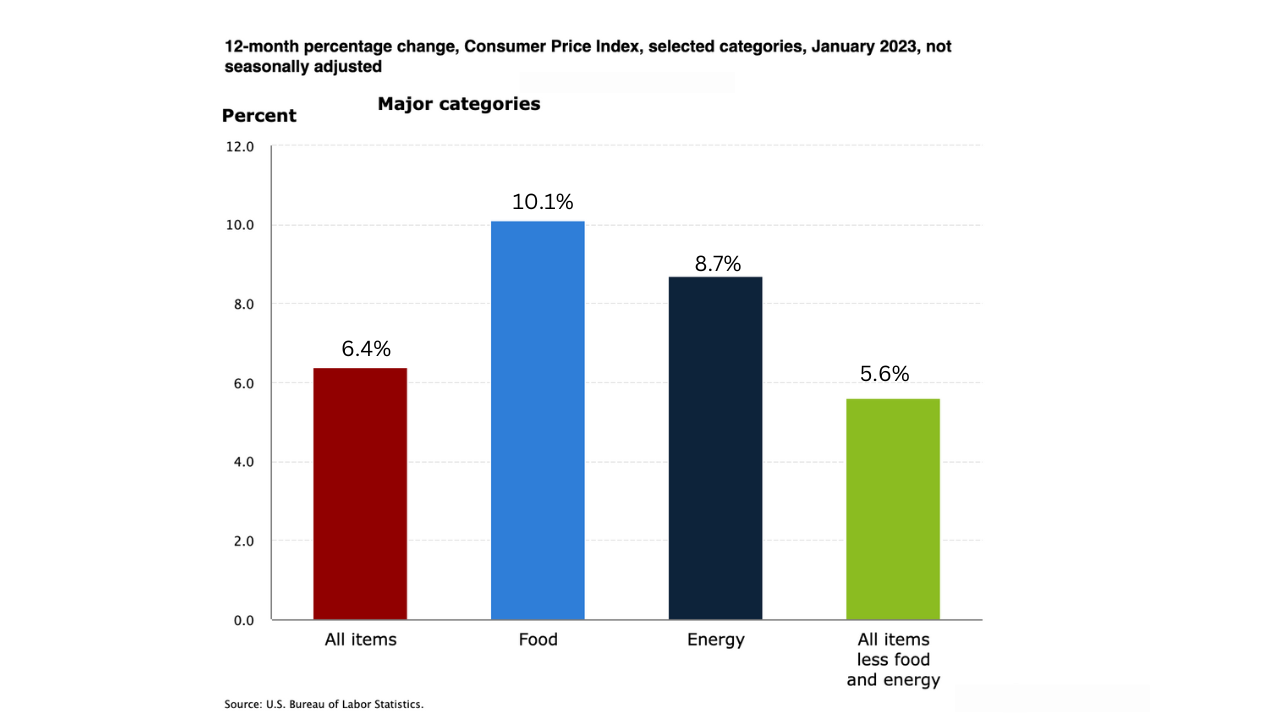

As you can see in the BLS chart above, the year-to-year inflation is 6.4% for all the items, 10.1% for food, 8.7% for energy, and 5.6% for all the things except food and energy. Also, in their press release, they mentioned the index for shelter was the largest contributor to the monthly inflation number.

By shelter, they mean rents and owner equivalent rent cost of housing.

If you look at this detailed table from them, it shows the breakdown in prices for all the individual items.

Under the energy category, fuel oil is still up by 27.7% for the 12 months. Natural gas is also up by 26.7% in the 12 months.

There is a 14% rise in Dairy and related products in the food category.

You can see that the highest inflation happened in cereal and bakery products. This was mainly because of the rise in egg prices because we felt that in the grocery stores.

What caused egg prices to rise so much?

Economists think the bird flu was the main reason behind increased egg prices because about 40 million egg-laying hens died in 2022 because of this disease.

At the same time and the demand for eggs continues to rise because it provides a cheaper source of protein to many Americans. Thus both these supply and demand factors contributed to a significant rise in egg prices.

Was this inflation expected?

This came as a little bit of a disappointment because people were expecting the overall inflation not to rise if not fall from the December level, even though fuel prices seem to be falling.

Inflation is still high on many essential things, and it continues to be the biggest hit to poor Americans. It acts like an indirect tax on them.

Unfortunately, most of this inflation we are experiencing is caused by supply-side factors, which are difficult to fix in the short run.

Policy implication

The government can only focus on controlling the demand aspect of inflation in the short run. As a result, the Fed will continue to tighten the monetary policy and raise interest rates until inflation reaches around 2%

The federal reserve has been trying to control inflation using interest rate hikes to slow the demand in the economy.

To learn more about inflation, how it is calculated, and the factors that cause it, please see my post here.