In my previous post, I wrote about the various types of assets you can use for investment. To have a diversified portfolio, you should invest in a variety of assets.

Diversification can mean two things:

The first is diversifying within the same asset class.

The second is having different asset classes in your investment portfolio.

So, for example, if you are investing in fixed-income securities, you need to invest in different types of those such as government bonds, corporate bonds, CDs etc.

Similarly, if you are investing in stocks, you should invest in multiple companies from different industries and sectors. But when you invest in individual company stocks, you may only be able to invest in 5, 10, or maybe 15 companies.

To achieve diversification using individual stocks, you will need to do a lot of research and invest a lot of money buying stocks from different companies in different industries.

Thus, if stocks comprise a majority of your investment portfolio, then your investment is risky because it is based on the performance of those companies you bought shares of.

So what’s the solution?

For a beginner investor, who doesn’t want to put too much money in several individual stocks, the best way is to start with investing in an index fund or a passively managed mutual fund.

What’s an index fund?

Index fund is a fund whose portfolio are built to mimic the constituents of a stock market index. The most widely used indices in the US are S&P 500 index or Dow Jones Industrial Average, or the Nasdaq Composite index.

Generally, Index funds should give you the same return as the index they follow. These funds buy all the stocks that are part of the index in the same proportion. So, it is like you have invested a little bit in each of those companies that comprise that market index. So yes, that would give you a very well diversified investment portfolio.

Also, index funds are less volatile and therefore are a good investment compared to individual stocks, esp. for long-term investing. So, they are a great option for investment for your retirement.

In my next post, I will argue why I like index funds more than actively managed mutual funds. I feel if you are sticking to read my post this far, you will be interested to know more.

Don’t put all your eggs in one basket!

The main point is to diversify so that if one sector or asset class doesn’t perform well, you don’t lose all your money.

The second key thing for diversification is having different asset classes in your portfolio, such as stocks, bonds, real estate, commodities, etc.

This brings us to the concept of asset allocation. Asset allocation simply means you decide what percentage of your money you want to put into each type of asset class.

Asset allocation will vary from person to person, depending upon their savings, age, risk tolerance and financial circumstances.

Finance theory suggests that generally, your investment in stocks should be 100 minus your age. So, if you are 25 years old, it should be 75% stock and 25% fixed income.

So yes, it means you need to keep changing your asset allocation as you grow older. Later in life, your investment in stocks should be less, and high in other fixed-income assets.

Now comes the million-dollar question.

When should you start investing?

The easy answer is now if you haven’t started already.

You can start investing as early as when you first start earning. Even kids can start investing their allowance money and add to it periodically.

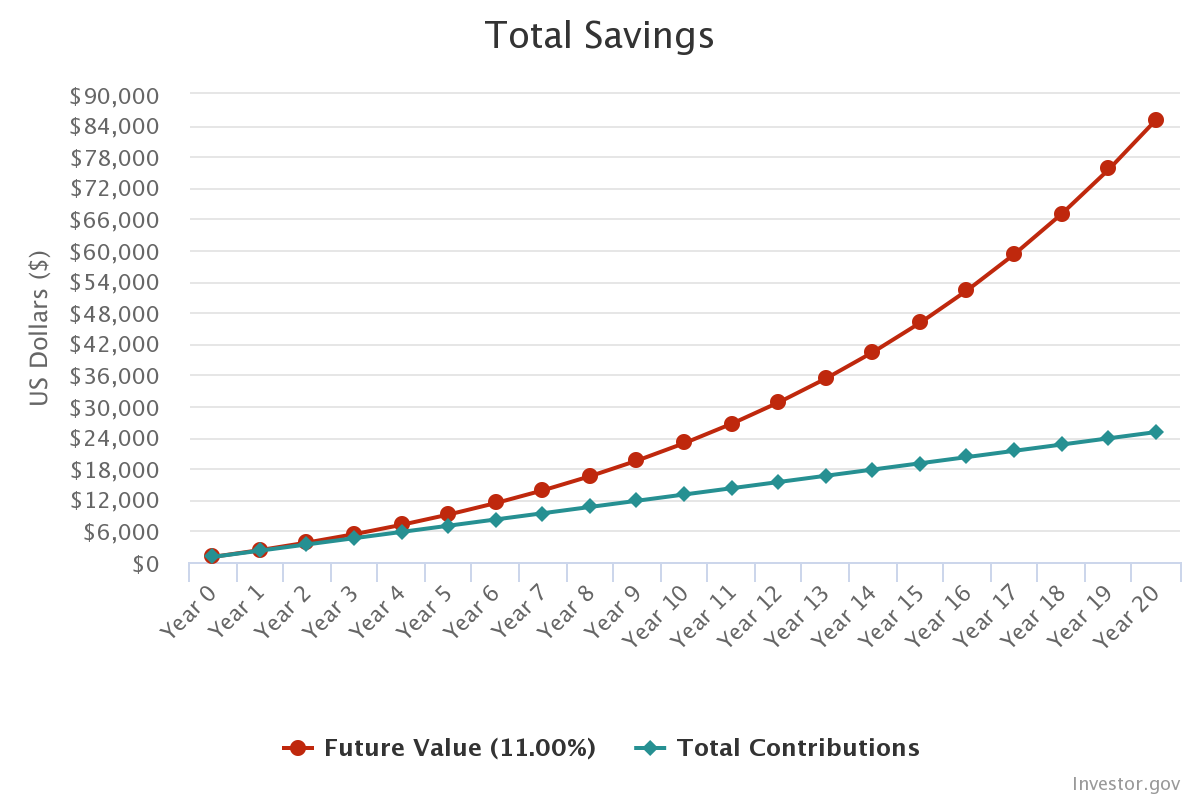

Time plays a huge role in making your money grow, more than the dollar amount you invest. This is due to the power of investing!

If you are not convinced, you can take a look at my post here, where I explain this concept by using some simple examples.

How much money do I need to invest?

In the past, you would need a substantial amount of money to start investing. But things are much more simple now. With no minimum, no commission brokerage accounts, and fractional ownership of shares, you can start investing with as little as $10 a month.

You can set aside $1-$5 a day and make monthly contributions of $30-$150 a monthly.

These are some of the top brokerage firms in the U.S. – Charles Schwab, Fidelity, TD Ameritrade, and Vanguard. Stay tuned for my post on how to open a brokerage account!

I hope you found this information useful, I will cover Real estate and commodity investment in another post! But this is useful info to start investing now.

Disclaimer: The information presented here is for educational purposes only. I am not a financial advisor and do not provide investment advice on an individual basis.

Credits:

Images- https://www.freepik.com