If I asked, “What’s the interest on your savings account?” many of you will tell me the interest rate that the bank is stating. However, you need to understand the difference between nominal and real interest rates.

In this post, you will learn about the true return you get by saving your money in a bank.

What is a nominal interest rate?

When you deposit money in your savings account at the bank, you get something called nominal interest. So, if your savings account has a 2.5% interest rate, that is actually a nominal interest rate.

A nominal interest rate is the interest rate banks and financial institutions give to you. It is the actual rate they will pay on your savings balance. This interest rate is not adjusted for inflation.

Before we dig into real interest rates, we need to understand what inflation is and how it impacts the real return on savings.

What is Inflation and how does it affect your actual return?

Inflation is the general increase in the prices of everyday goods and services we use. It is important to note that the price of one item can go up and down, but the increase in any single item won’t qualify for inflation. Inflation happens when price rise for a majority of goods and services we use. In other words, inflation only happens when the average price level is going up. For example, when the prices of food, housing, gas, and other items we use, all rise for a while. I have written a detailed post on inflation in another post if you are interested.

Real interest rate – the one that actually matters!

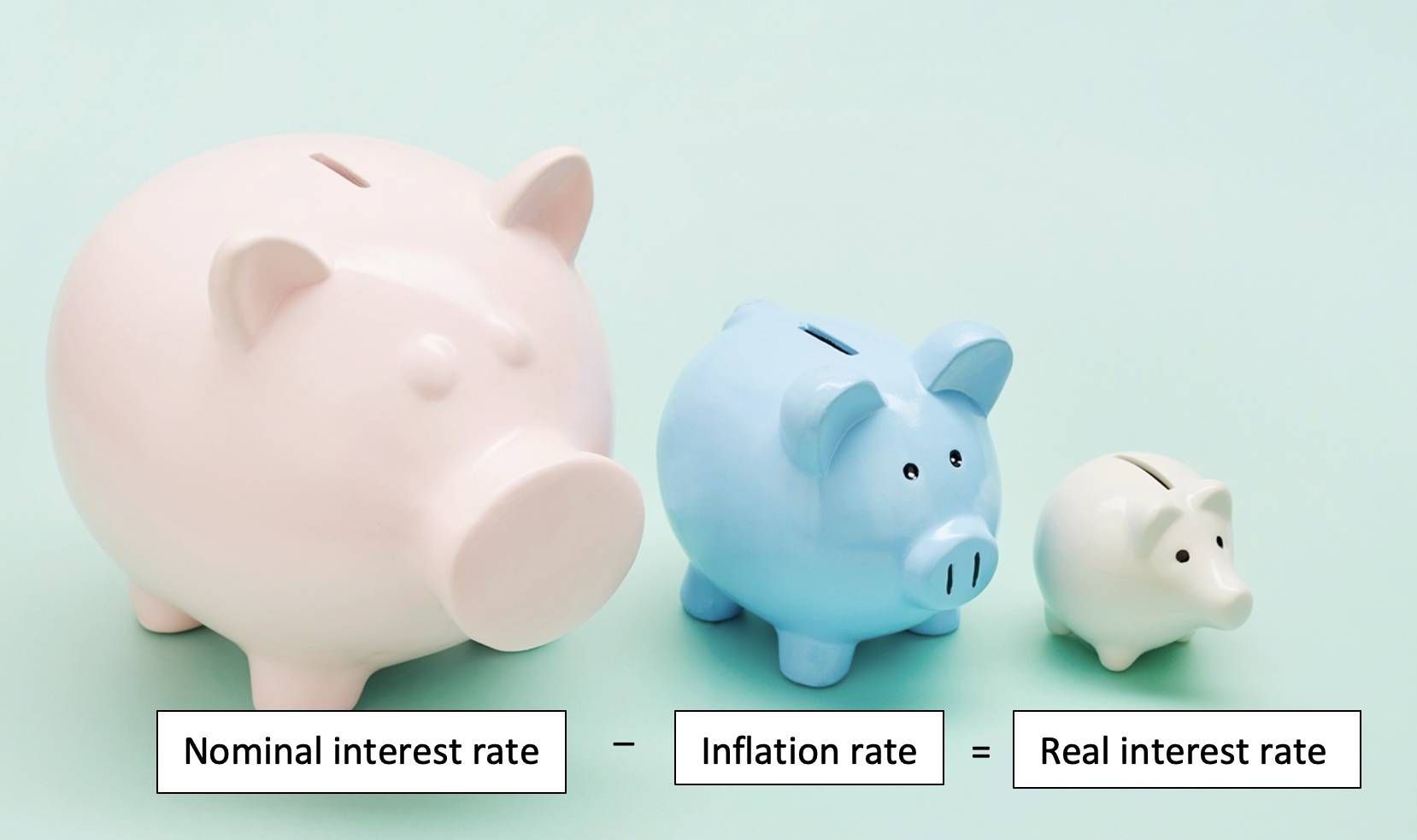

If there is any inflation in an economy, money loses its value or purchasing power. So, the interest you earn from the bank won’t buy the same amount of things it could before the price rise. Thus, we need to calculate the real interest rate. This is the rate we get after subtracting the inflation rate from the nominal interest rate your bank quoted to you. So, the real interest rate r is

r = nominal interest rate- Inflation rate

This is called Fisher’s equation in economics, named after American economist Irving Fisher. He explained the difference between true or real interest from nominal interest.

Thus, we will only earn interest income on our savings, when the real rate of interest is positive. If this number is positive, we haven’t lost money and actually gained some by keeping it in bank.

Let’s learn this by an example. Think of a big balloon with some air. Here air is the money you deposited in your savings account (balloon). Now, let’s think of the “nominal interest” you earn on your savings as the rate you are blowing air in the balloon to make it bigger. But let’s suppose there is a hole in the balloon, which is making the air come out of it as well. This air coming out of the hole is representing inflation in an economy.

If you’re blowing faster than the air that is coming out of the hole, your balloon will become bigger. And if your balloon is getting bigger, then purchasing power of your money in a savings account will grow over time. This is when you are earning interest in a real sense, and you will be able to buy more things.

But if the hole is bigger, the air will come out faster than the air going in. This will cause your balloon size to decrease, which means your purchasing power will go down.

So even if you are getting a nominal interest on your savings account from the bank, because of inflation, you will only be able to buy fewer things with that money in the future.

So, the real interest rate could be positive, zero, or negative depending on whether the inflation rate is less, equal, or more than the nominal interest rate.

If the real interest rate is zero or positive, then saving your money in a bank is still better than keeping it with you.

When you keep money in your house, it certainly will depreciate by the rate of inflation. The only time keeping money in the house will help is when there is a deflation, which means the general price level is going down.

In the chart below, you can see how inflation affects your true savings return.

Does anyone benefit from stable inflation?

Savers, borrowers, and lenders all benefit when the inflation level is stable and low (around 2%). For borrowers, it helps them pay off their loans because they are paying a little bit less in real terms.

Banks know the target rate of inflation, so they keep their nominal lending rate of interest higher than that. This helps them get some real return on lending money.

Similarly, for depositors, if inflation is stable, they get the real return as the excess of nominal return over the inflation rate.

However, if inflation is more than the normal 2%, then both lenders and depositors will lose money.

To learn about what measures the Fed takes to keep inflation stable at around 2%, please click here.