Yesterday, in the news, I read President Biden saying the US had 0% inflation in July. The BLS, the official source of inflation numbers, reported no change in the CPI (Consumer price index) from June.

So did inflation suddenly disappear? Well, it depends on how you measure it.

Sometimes, the way politicians report some facts could give us misleading conclusions. So, the economist in me had to write something today to help my readers understand it better.

How do we measure inflation?

As I said above, the official inflation number in the US comes from the BLS every month. BLS calculates price inflation both monthly and annual.

If you want to know more about inflation in simple words, you can read my previous posts. I described how we can calculate inflation using some simple examples. I also explained what policy measures the central bank takes to control inflation – my most favorite post.

So was Biden lying when he said 0% inflation?

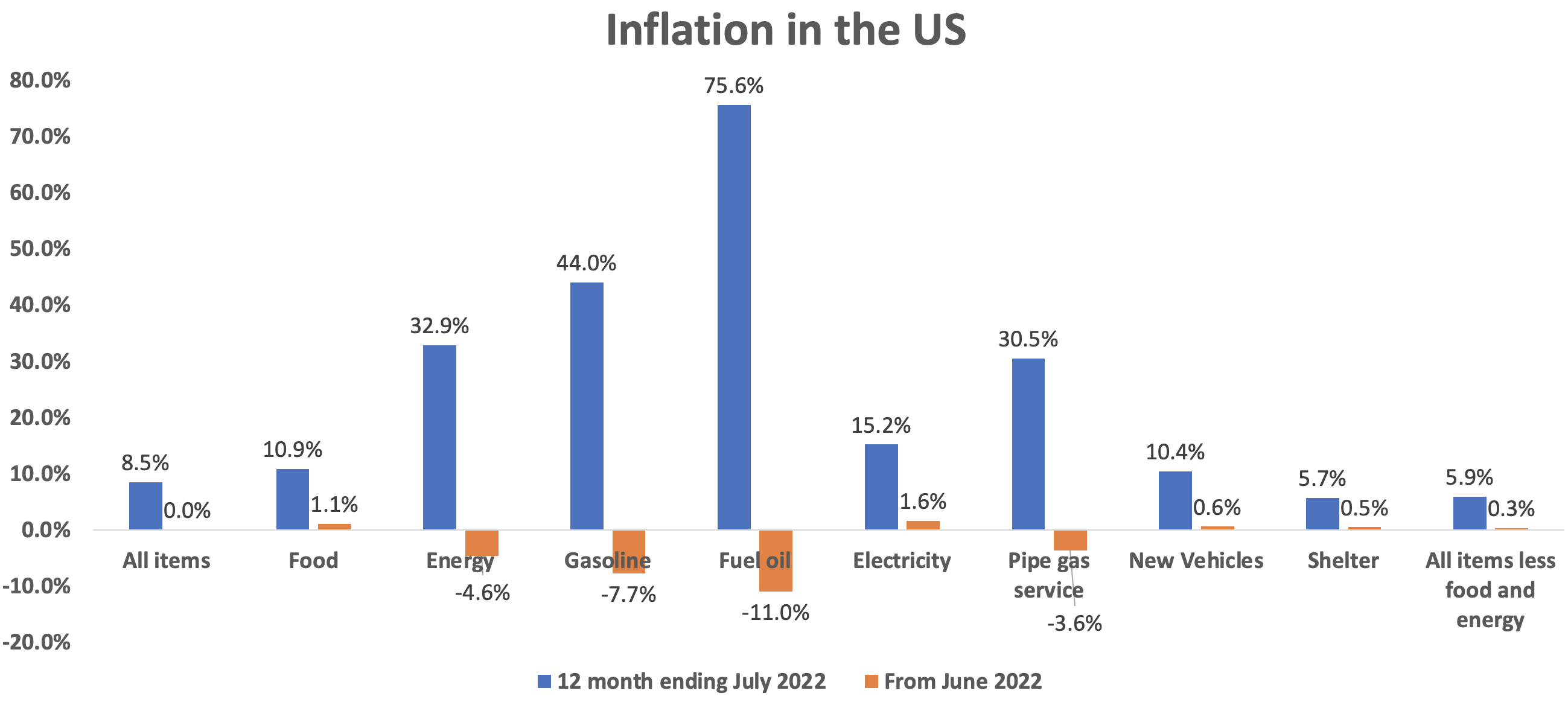

There was indeed no general average price increase from June 2022 compared to July 2022. This meant a 0% monthly inflation.

However, the year-to-year inflation ending July 2022, was 8.5%. This is still very high, compared to the average US inflation of around 2%. Inflation is the percentage price increase of a basket of goods and services people in the urban United States use. This is of course, over a specific period.

But, the good news is that it was somewhat less than the June 2022-to-2021 inflation of 9.1%.

A picture is worth a thousand words

Here is a chart showing category-wise inflation. The food prices continued to rise. Few others, such as electricity, new vehicles, and shelter also rose.

The main reason behind 0% monthly inflation was the falling gas prices. It offset the increase in food and shelter indexes. The lower gas prices finally come as a relief to millions of Americans. We have been experiencing a sharp rise in gas prices for a long time and wanted a break.

Hopefully, Fed’s tight monetary policy will bring inflation down further in the coming months. But, there might be a cost to it- the possibility of a recession. As we say in economics, there is no free lunch. Let’s just hope that even if the R word happens, it is not significant.